Unlock Your Financial Potential: From Zero Savings to a Tailored Investment Plan

Our innovative tools, expert guidance, and efficient wealth management strategies will help you go from Zero Savings to a tailored investment plan designed to help you achieve your financial goals.

Join thousands who save daily

to meet their goals

Create a tailored

Investment plan

Earn competitive returns

on your savings

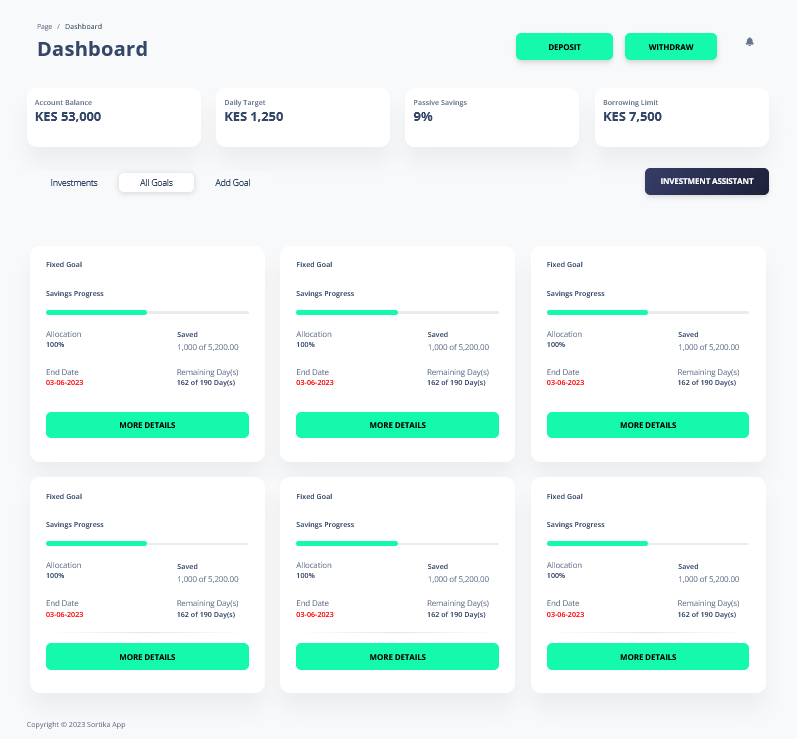

Track your progress

inside the app .

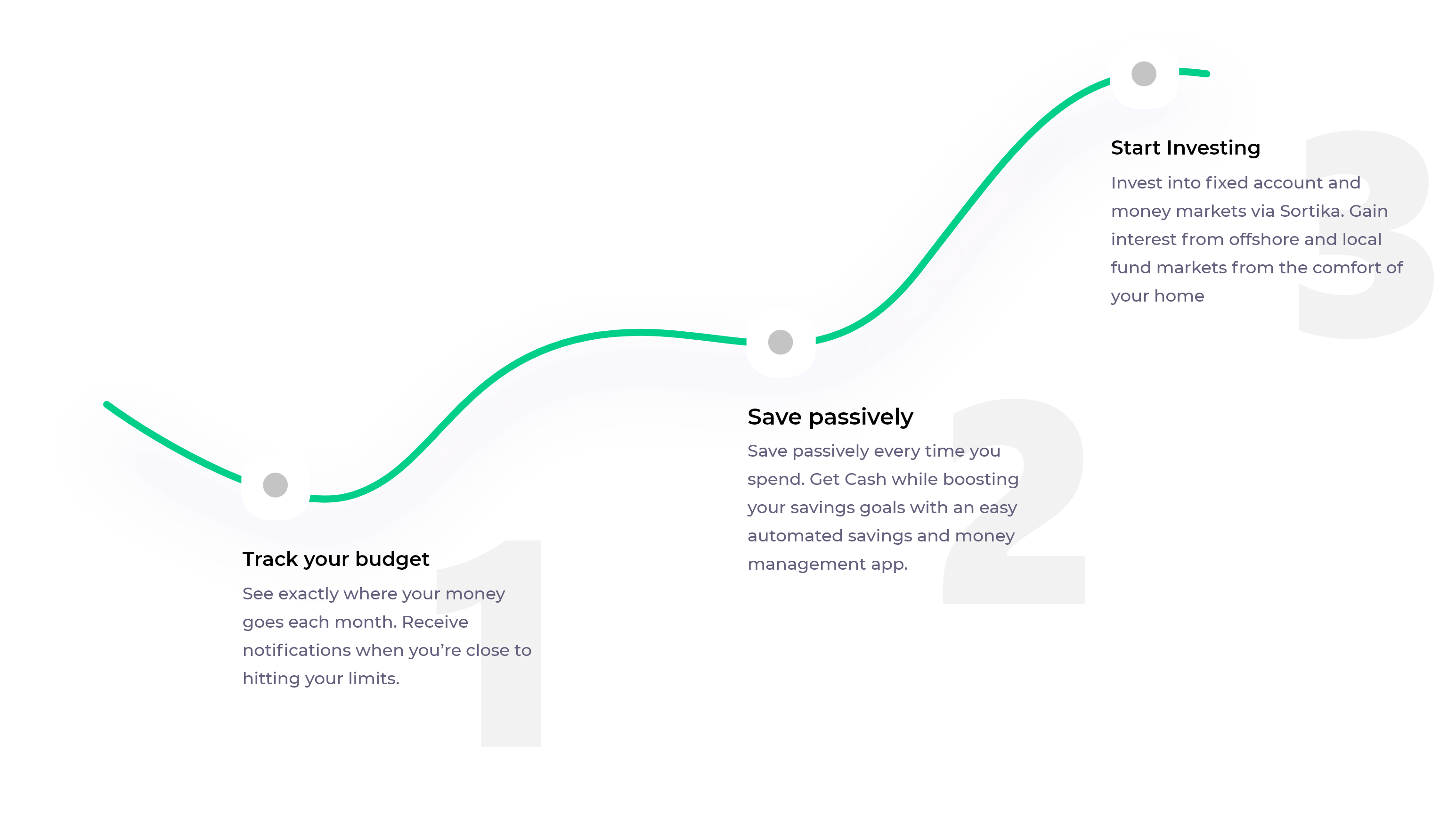

YOUR JOURNEY TO FINANCIAL FREEDOM

We are your one-stop-shop for managing your wealth and money.

We understand that managing your finances can be overwhelming, especially when it comes to saving, investing, and creating a sustainable diversified portfolio. That’s why we’ve created a platform that simplifies the process and helps you achieve your financial goals.

Why Sortika?

Save Seamlessly

The app has been useful especiallly with the passive savings. Now am disciplined with my savings and it has become effortless and seamless to do it via sortika app.

Being your own boss

The Be Your Own Bank goal concept makes me feel like I am running my own bank. From saving, to accessing self loan and being able to repay myself, increasing my cashflow.

Budget with no fees

The budget planner has helped me monitor my expenses and income. I have been able to track how I use my money and that has helped me adjust when need be.

Our Goals?

Our goal is to empower individuals to take control of their finances and reach their financial goals through innovative savings, budgeting and investment solutions.

We help you save and meet the goals that matter to you.

Use your savings & investments on the app to lend or borrow.

[E-Chama] Save, invest, lend and borrow as a group.

Simple way to build a sustainable savings culture.

Frequently Asked Questions

Want to know us more? Explore the answered frequently asked questions (FAQs)

Sortika is a mobile based personal wealth management solution, that allows customers to create and meet their wealth building and life goals.

Download Sortika app from Google Play Store or App Store (link to download) Fill in your details. Create the goal you would want to save in from the listed goals. Start saving. (Passively or actively)

We have 4 goals on the Sortika app.

- BYOB:- The BYOB is an admin defined goal designed with strategies that helps a user operate like a bank. The emergency fund is purely to save funds that would ideally be needed in an emergency. The fund can be used as an income earner by lending the funds therein to other Sortika users.

- Savings goals: Under savings goals, we have 3 types:

Custom goal– This is a user defined goal that only helps the user save and can withdraw at any time

Premium goal– This is a goal towards purchase of items/services being distributed through Sortika App.

Fixed goal-These are goals pre-defined by Sortika admin. They have a fixed time and amount. - Investment Goals: These are goals created towards making an investment/to earn a passive income. We provide access to various investment asset classes including but not limited to money market funds, certificate of deposits, REITS, Bonds, treasury bills, off shore stocks, local stocks, Global funds etc.

- Group Goals: These are goals by groups such as chamas, self-help group, mchango groups etc. Members create a group and their savings towards the group fall under the category of group goals